Economical

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

A reliable direct lender with fresh solutions. We protect your information and assist during challenging times

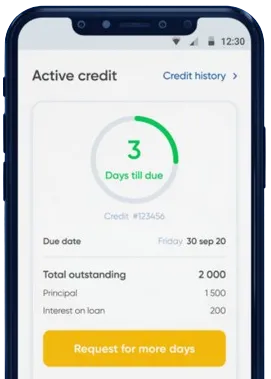

Get fast and simple solutions without stepping out. Instant fund transfers with options to extend loans

Initiate your application on our app by completing the required form.

Wait for our quick decision, which takes only 15 minutes.

Secure your funds, generally processed in just one minute.

Initiate your application on our app by completing the required form.

Download loan app

When faced with a financial emergency, the last thing you need is a lengthy loan approval process. Instant cash loans in South Africa offer a fast and convenient solution for those in need of quick cash. These loans can be approved in as little as 5 minutes, providing immediate relief to borrowers in urgent situations.

Here are some key benefits of instant cash loans in South Africa:

One of the main advantages of instant cash loans is the quick approval process. Traditional loans can take days or even weeks to be approved, but with instant cash loans, you can receive approval in just 5 minutes. This means you can access the funds you need right away, without any unnecessary delays.

With the fast approval process of instant cash loans, you can have peace of mind knowing that you have a reliable financial solution at your fingertips.

Applying for an instant cash loan in South Africa is simple and convenient. Most lenders offer online applications, allowing you to apply from the comfort of your own home. The application process is quick and easy, requiring minimal documentation and personal information.

Instant cash loans in South Africa offer flexible repayment options to suit your individual needs. Whether you prefer to repay the loan in one lump sum or in instalments, you can choose a repayment plan that works best for you. This flexibility makes it easier to manage your finances and avoid falling into debt.

Instant cash loans are ideal for those who need emergency financial assistance. Whether you have unexpected medical bills, car repairs, or household expenses, these loans can provide the immediate relief you need. With quick approval and access to funds, you can address your financial obligations without delay.

Instant cash loans in South Africa offer a fast and convenient solution for those in need of quick financial assistance. With a quick approval process, convenient application, flexible repayment options, and emergency financial assistance, these loans provide a reliable and efficient way to address financial emergencies. If you find yourself in need of immediate cash, consider applying for an instant cash loan in 5 minutes in South Africa.

An instant cash loan in 5 minutes is a quick and convenient way to borrow money. You can apply online or through a mobile app, and if approved, the funds are typically deposited into your bank account within minutes.

Eligibility requirements may vary by lender, but generally, you must be a South African citizen or permanent resident, have a regular income, and be over 18 years old. You may also need to have a bank account and a valid ID.

The amount you can borrow with an instant cash loan in 5 minutes depends on the lender and your financial situation. Typically, these loans are for small amounts, ranging from R500 to R5000.

Interest rates on instant cash loans in 5 minutes can be high compared to traditional loans. It is important to carefully review the terms and conditions before applying to understand the interest rate and any additional fees.

Some lenders offer instant cash loans in 5 minutes to individuals with bad credit, but the interest rates may be higher. It is recommended to check with the lender to see if they consider applicants with poor credit history.

Repayment terms vary by lender, but typically, instant cash loans in 5 minutes are short-term loans that must be repaid within a few weeks to a few months. It is important to understand the repayment schedule and make timely payments to avoid additional fees or penalties.